When it comes down to doing business in Europe, Business Owners should focus their attention on Malta: A small island in the Mediterranean based midway between Europe and Africa, the thriving island nation has become a highly attractive jurisdiction for business over recent years thanks to its advantageous corporate tax regime, geographical position, and several other business-friendly incentives. Are you an entrepreneur who is considering expanding or starting up your global business? Read our detailed guide on why you should consider doing business in Malta.

Historically Dynamic Economy

Malta’s limited natural resources and fresh water supply leave the small island nation looking towards alternatives to fuel the economy; So what makes Malta’s economy boom? Malta’s dynamic economy is driven by iGaming, aviation, marine, financial, tourism, real estate, and manufacturing – specifically of electronics – services.

Malta’s membership to the European Union, its geographical position, and several other environmental factors, have aided these diverse sectors in succeeding so rapidly and attracting a collection of foreign direct investment, resulting in a historically dynamic economy.

A member of the European Union and the Eurozone

Malta’s entrance as a European Union Member State in May of 2004 was part of the largest EU enlargement to date, as Cyprus, Slovenia, Lithuania, and 6 other European countries joined on as Member States. Since Malta has joined the European Union, it’s led to significant economic, political, and social developments for the small, Mediterranean Member State. With access to the European Union’s international market, and over 447 million people, Malta has seen an influx of foreign direct investment over recent years.

Geographical position

Malta’s advantageous position in the Mediterranean is beneficial for both business owners and consumers; Located midway between the shores of Sicily and North Africa, Malta’s incredible geographical location positions the country on the fringe of the Middle Eastern, African, and European markets. Malta’s geographical location to the equator creates an environment with an abundance of sun, seeing over 3,000 hours of pure sunshine and water temperatures as warm as 27 degrees Celsius in the Summer months. Malta’s famous reputation as a Summer destination brings in an average of 1.4 tourists per resident annually.

Excellent infrastructure and telecommunications services

Although Malta is a small island nation, the government has invested significantly into the country’s infrastructure and telecommunications services. Telecommunication services have been well developed in Malta, with around 300 wifi-hotspots found throughout the islands. Malta is excellently connected due to its various road networks and ferry services, connecting residents seamlessly across the country; Residents can make use of over 2,000 bus stops via the Public Transport services in practically every locality across the Maltese islands. Residents can opt to use ferry services to transit around the Maltese islands or to nearby Sicily.

A Stable Political Climate

Malta’s political framework is based on a parliamentary representative democratic republic.

Malta has enjoyed a stable political climate for several years, creating an ease of business for entrepreneurs who carry out budgeting, corporate taxes, or are navigating through regulations for their business. Regular elections and periodic rotations of power have been observed over passing years, with Malta’s elected government officials even opting to introduce a package of constitutional reforms in July of 2020 in efforts to strengthen Malta’s anti-corruption agency.

Malta’s Economic Contributors by Sector

Considered an advanced economy by the International Monetary Fund, Malta’s economy is built around highly industrialized, service-based solutions. Malta’s main economic contributors by sector are Agricultural, Industrial, and Tertiary.

Agricultural

Malta’s agricultural services have a small impact on the overall GDP, contributing less than 1% annually from 2015 – 2020. Malta’s limited surface area and land size inhibit the agricultural capabilities of the island. Annually, about 38,000 metric tons of agricultural crops are produced, with potatoes accounting for 32,000 metric tons of the annual crop produced.

Industrial

Industrial services in Malta have accounted for an average of 12.5% of the overall GDP from 2015 – 2020. Malta’s industrial services include operations in pharmaceuticals, advanced manufacturing of medical devices, automotive components, and electronic components.

Tertiary

Malta’s tertiary services account for the largest portion of the annual GDP, resulting in an average of 75% annually from 2015 – 2020. Malta’s tertiary sectors have seen the most success, which include: real estate, iGaming, finance, marine, and aviation, due in part to the asset rich workforce and direct foreign investment into these growing sectors.

Advantageous Tax Regime

Malta’s advantageous tax regime is well known throughout Europe and has been attracting entrepreneurs to the island for years; Despite the effects of the pandemic, Malta saw 3,211 new companies registered in 2020, an average of 8 companies registered per day in 2020.

Business owners looking to open business Malta can enjoy some of the following tax benefits:

- “Full Imputation Tax System” for Shareholders of Maltese companies: Dividends distributed to shareholders will not be subject to personal tax as the corporation has already paid the taxes due on profits. This prevents double taxation on the dividends usually incurred in the traditional tax system. Australia, New Zealand, and Malta are the only countries world-wide which implement the full imputation tax system;

- A tax refund is applied on the corporate tax rate, applicable at 35%;

- ‘High Net Worth Individuals’ schemes are available for foreign citizens wishing to receive residence in Malta by means of various relocation schemes;

- Incentives on investments under the Business Promotion Act, Malta Enterprise Act, and Business Promotion Regulations.

Read More on Malta’s Advantageous Tax Regime

Uncomplicated Business Legislature

Uncomplicated business legislature has positioned Malta as one of the most business-friendly countries in Europe; In 2019, Malta placed 88th among 190 countries in terms of ease of doing business. By keeping legislature simple, the Maltese Government has opened Malta up to business owners from all over the world who are interested in starting a business on the islands; Entrepreneurs who wish to open a company in Malta may succeed in just 16-20 days,

Diverse Business Infrastructure

In recent years, Malta has experienced an influx of multinational corporations opting to do business in Malta. The Maltese government’s pro-business approach towards:

- the development of new investments;

- upgrades to its national infrastructure;

- and forward-looking policies

have been key to the successful impact of Foreign Direct Investment (FDI) in Malta.

Thanks in part to its uncomplicated business legislature and diverse business infrastructure, small business owners and heavy-weight international corporations have chosen Malta as their top destination to do business. Business owners choose to operate their business in Malta to unlock access to several international markets due to its strategic geographical location and global connectivity.

Asset Rich Workforce

Malta’s diverse population contributes to its highly skilled and multilingual workforce. English is the predominant language spoken in Malta, generating an accessible work location for any English-speaking individual. Malta’s population is commended for its highly skilled workforce, with many residents seeking a quality, higher education before entering the workforce. Business owners who opt to do business in Malta can be assured their business will be represented to the highest regard.

A highly educated workforce

The Maltese workforce has been recognized for its highly skilled and educated labor pool. The University of Malta reported there are some 11,300 students in attendance at the University, which include 1,500 international students spanning more than 127 countries. As the tertiary sector continues to grow, today’s youth have invested their future into the industry, with over 2,000 students at Ġ.F. Abela Junior College are registered for pre-tertiary studies.

On average, 3,500 students graduate from the university annually.

A bilingual workforce

Thanks to the long-standing relationship with the UK and droves of expats settling into the island, over 88% of the Maltese population fluently speaks English, and 66% fluently speak Italian. The official languages of Malta are Maltese and English, creating an ease of business on the island.

Where should I locate my business in Malta?

Depending on your business ideations, Malta can provide the ideal location for your business to thrive. The island provides several options for working via: public spaces, cafes, restaurants, or serviced office providers. Business owners who are looking to do business in Malta should consider coworking and serviced office space provider SOHO Office Space.

Create a lasting impression for your business in Malta with a workspace with SOHO. Plug N’ Play in your private office or coworking desk surrounded by like-minded individuals.

Is Malta Business Friendly?

Yes! Malta has become an increasingly attractive country to conduct business within the European Union. It’s:

- Excellent infrastructure and telecommunication services;

- Stunning weather and tropical climate;

- Highly skilled workforce;

- Advantageous Tax Regime;

Create the ideal package to conduct business on the Maltese islands.

What is the Tax Rate in Malta?

Depending on your status, your tax obligations in Malta can vary. Malta has a very advantageous tax system, however it is important to know where your tax responsibilities lie for your business in Malta.

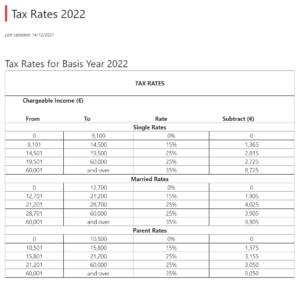

Individuals can check their tax rate in the chart below via the Commissioner for Revenue:

Corporations are due to pay taxes at the applicable rate of 35%.

Read more about Malta’s Tax Rates

Can Foreigners Open a Company in Malta?

Yes – entrepreneurs who wish to open a company in Malta who do not hold Maltese citizenship are able to do so in a few, relatively simple steps:

Step 1: Select your Company Type

First, select your company type. Entrepreneurs looking to set up their business in Malta have a choice of 4 types of companies:

- Limited Liability Companies

- General Partnership

- Single Proprietorship

- Overseas Company

Step 2: Select your Company Name

Your company name is the very first impression your business makes, so it’s essential to select a company name that:

- Reflects your business activities accurately

- Does not related to a pre-existing corporate body

- Does not contain any offensive language

Step 3: Prepare the Necessary Documentation

In order to proceed with setting up your company in Malta, you now need to gather all of the relevant documentation required by the Registrar of Companies Association of Malta. Firstly, you will need to prepare the Memorandum of Articles and Association.

Further documentation required must support proof of a paid share capital. Depending on the company’s authorized share capital, the enterprise will be subjected to an additional fee for registration.

Step 4: Gain a Certificate of Company Registration

Once the necessary documentation provided in Step 3 has been approved by the Registrar of Companies Association of Malta, a Certificate of Registration will be issued to the enterprise. This document will provide proof the company exists and is authorized to conduct business in Malta.

Step 5: Register for a Maltese VAT Number

Once receiving the Certificate of Registration for your company, you must then register your company to pay Value Added Tax (VAT) at the local rate of 18%.

The procedure for registering for a VAT Number varies on the type of company registered, and whether the applicant is in possession of a Maltese issued Identification Number, or a Foreign issued Identification Number.

Business owners who opt to do business in Malta enjoy numerous advantages; Entrepreneurs can expect business-friendly legislature, a highly skilled, multilingual workforce, an advantageous tax regime, and an ease of doing business when operating in Malta. Business owners can be assured their business will be represented to the highest regard, while reaping benefits of global connectivity and international markets.

Entrepreneurs interested in doing business in Malta should consider a serviced office space or coworking provider to kick-start their business presence on the island. SOHO Office Space offers 360 workspace solutions for businesses at any stage of their development.

Contact the SOHO Team today to discuss your next flexible workspace solution.