Many seek out the Maltese islands for various reasons; the abundant days of sun, favorable tax laws, the Mediterranean beauty, or to kick start your journey of self-employment. Well known throughout Europe, Malta provides many laws which support a great jumping off point for those looking to become self-employed. In this article, we’ll discuss everything you need to know to become self-employed in Malta, why you should, and more!

Benefits of Being Self-Employed

Besides the great tax benefits, who doesn’t want to be their own boss? Becoming self-employed finally gives you the opportunity to control your routine and independence; companies or individuals who seek your services are your clients, not employers. Commonly, clients will state their expectations of the service you’re providing, however they’re not in control of your work. This creates a great sense of security for some – reassuring how, when, and where the job gets done.

What do you need to be eligible?

For any Maltese national, applicants will have to provide a valid Maltese ID card upon registration. If you are foreign to Malta, or have never worked on the island, it is required to first secure a Social Security number before proceeding with self-employment applications. You can find the application form, titled ‘Sole Proprietor’, on the Commissioner for Revenue website, under ‘income tax,’ then ‘small businesses’.

Furthermore, if your business will be importing and/or exporting any goods through the country, it’s suggested to get an EORI number.

For Third Country Nationals (TCN) the process is more limited; any TCN in Malta wishing to become self-employed must comply with the following steps:

- A Third Country National must invest in Maltese Capital Expenditure of at least €500,000.00 within the first 6 months after receiving the Jobsplus License. The Capital Expenditure may solely consist of fixed assets, such as immovable property, plants and machinery used for business purposes, which must have been included in the detailed business plan attached to the application. Receipts of such purchases made in the TCN name are to be included to support the application. A reference letter with respect to the TCN from a reputable Maltese Bank must also be attached, supporting the facility to raise the Capital needed;

- A person who is a highly skilled innovator with a legitimate business plan whose application has committed to recruiting at least 3 EEA / Swiss / Maltese nationals in the first 18 months of establishment;

- A person leading a project which has been formally approved by Malta Enterprise and formally notified by Malta Enterprise to Jobsplus.

“In the case of (1) above, a Business Plan is required, indicating clearly when such investment is to occur, within twelve months from application. In the case of (2) above, the Business Plan must be submitted with the application. In the case of (3), evidence of such representation is required on application. In the case of (3a), formal notification by Malta Enterprise is required on application.”

It has been noted applicants who demonstrate a clear commitment to recruiting Maltese, EEA, or Swiss nationals create a more favorable application.

Do you have to register as self-employed in Malta?

Yes, you do.

To register as self-employed, one simply needs to visit this government site, and everything is quick and straight forward.

First, you will need to choose what you wish to apply for, either: ‘Sole Proprietors in possession of a valid Maltese Identity Card’, or ‘Company Legal Representatives,’ if none of the above applies for you, there is an ‘Other Applicants’ choice which you can select.

If you select the ‘Sole Proprietors in possession of a valid Maltese Identity Card’ option, you will be asked to give your ID Card Number and ID Document Number. After that, you are required to then fill out your basic information, like address and phone number, to proceed.

After this step, you will be required to state what service your business will be providing. You will be asked your wage, for tax purposes, also if you will be working full or part-time as self employed, if this is your only form of income, and other questions of the sort.

Soon after filling the online form, you will receive an email with your VAT number. Shortly after, you will receive an official certificate with your VAT number in the mail. The online registration process might take you around 10-15 minutes to complete.

Do Self-Employed Pay Tax?

A person who is self-employed must arrange their own social security, unlike someone who has an employer who deducts the income tax and social security from wages on your behalf. For self-employed people, the tax rate on yearly income is 15%.

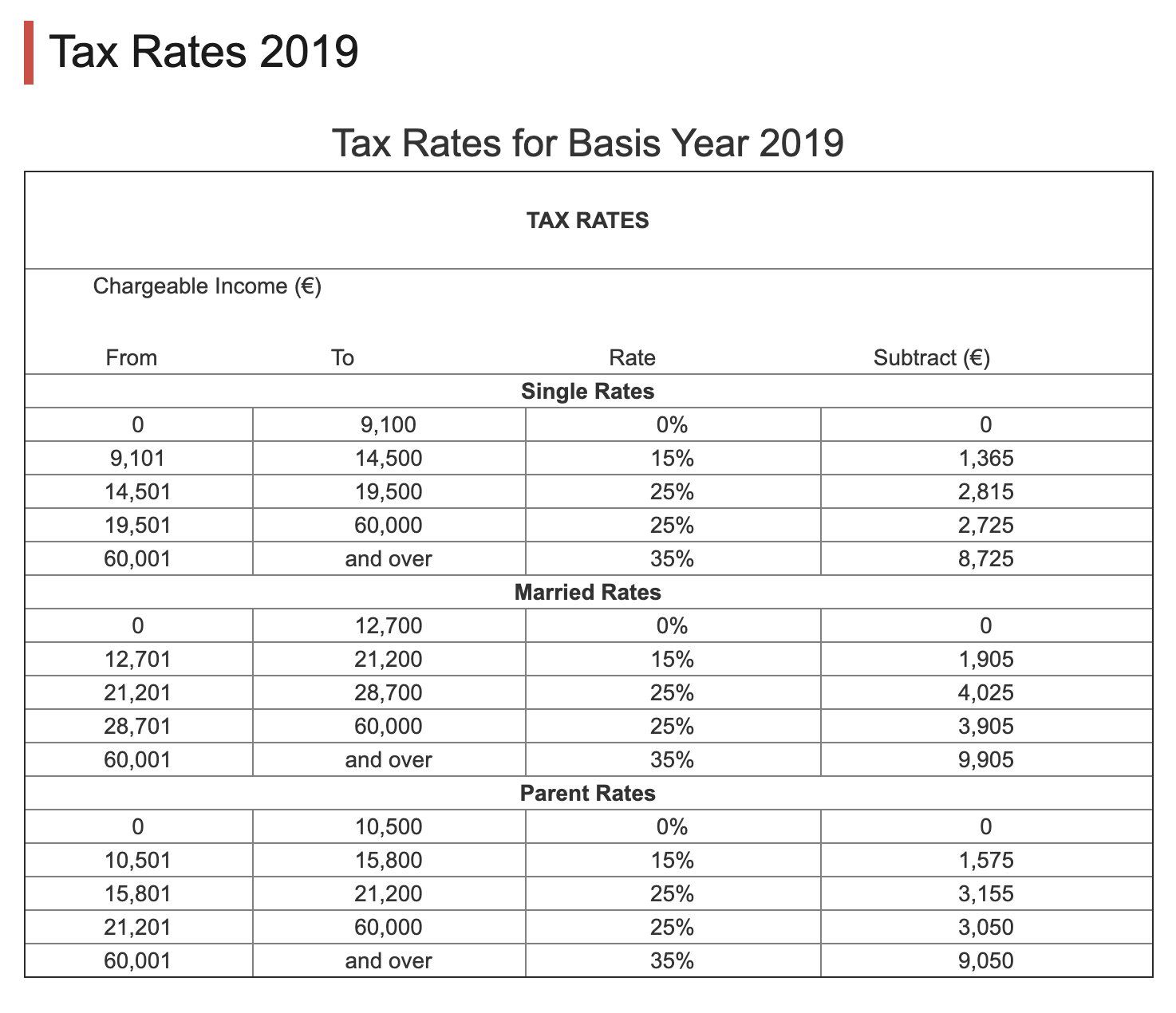

When it comes to income tax, if you make under €9,100 no tax will be deducted. From €9,101 to €14,500, the tax rate is 15%, from €14,501 to €19,500, the tax rate is 25%. From €19,501 to €60,000, your tax rate is 25%, and from €60,001 and above, your tax rate is 35%.

Then there are married rates and parent rates which can affect tax increases or decreases.

Advantages of being Self-Employed

Self-employment is a great way to branch out of your comfort zone and apply something you’re passionate about. Whether it’s part time or full time, earning some extra money as your own boss is greatly empowering, while also engaging skill sets otherwise not recognized.

Having full ownership of your business and service, you are the boss! Deciding what, when, and how your service will be delivered is entirely up to you.

Client satisfaction will create opportunity; word will spread, especially in a small country like Malta, where business networks are strong and abundant. Deciding to become self employed is always a journey of its own, certainly not an easy one. Do not lose heart at the first sign of adversary, growth will happen sporadically. Time and experience will give you a chance to mould your product into its greatest form; as a great poet once said, “Rome wasn’t built in a day, but they were laying bricks every hour.”

Coworking in Malta

As a freshly self-employed person, getting your business off the ground can be nerve-wracking. For some, working alongside others in a similar position can be reassuring. Joining a coworking space puts you into a space with like minded people, most of whom are operating their own businesses. Coworking spaces are a great way to expand your network, collaborate with other start-ups, and gain valuable knowledge from other perspectives on a similar journey as you.

At SOHO, one of our greatest services is our coworking spaces. Offering desks to rent by the day, the week, or the month(s), in an open space, this allows you to join Malta’s largest business network on terms that suit you.

Interested in trying out SOHO coworking spaces? Contact us about our free trial day, or book yours now!

Discover our coworking space in a video:

Credits:

https://integration.gov.mt/en/Work/Pages/Obtaining-Self-Employment-License.aspx

https://cfr.gov.mt/en/Small%20Businesses/Pages/SME-Registration.aspx

*The information used in this article was sourced through government websites, documents, and local advisors. However, it is recommended to seek local advice from a professional within the industry for full information regarding the appropriate steps for your personal experience.